How Analytics Are Creating New KPIs In Real Estate

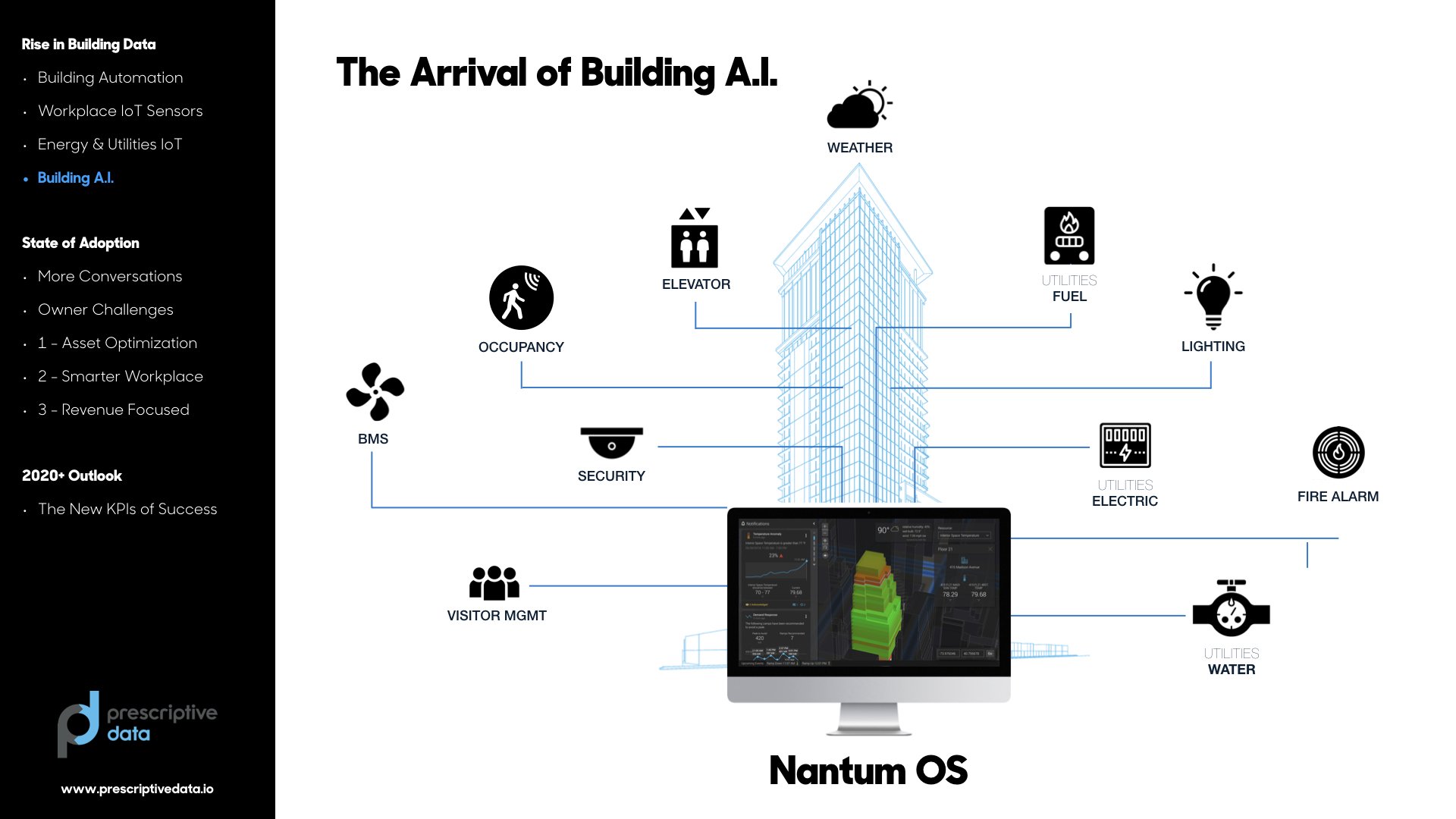

In 2016, Rudin Management, one of the largest real estate companies in New York City, announced the public launch of Prescriptive Data, a building operating system, after developing and utilizing the software in-house for some years. “This was purpose-built in response to, and in the face of, certain specific challenges that Rudin Management was facing,” said Sonu Panda CEO of Prescriptive Data. Their Nantum software helped Rudin reduce their GHG emissions and save $5.5 million a year (for several years in a row) on energy costs alone. “So, as a result, while we talk a lot about energy savings, [or] we talk about how we can really turbocharge the efforts of organizations to pursue and make progress against their ESG and sustainability goals, we do all of that through the lens of asset management.”

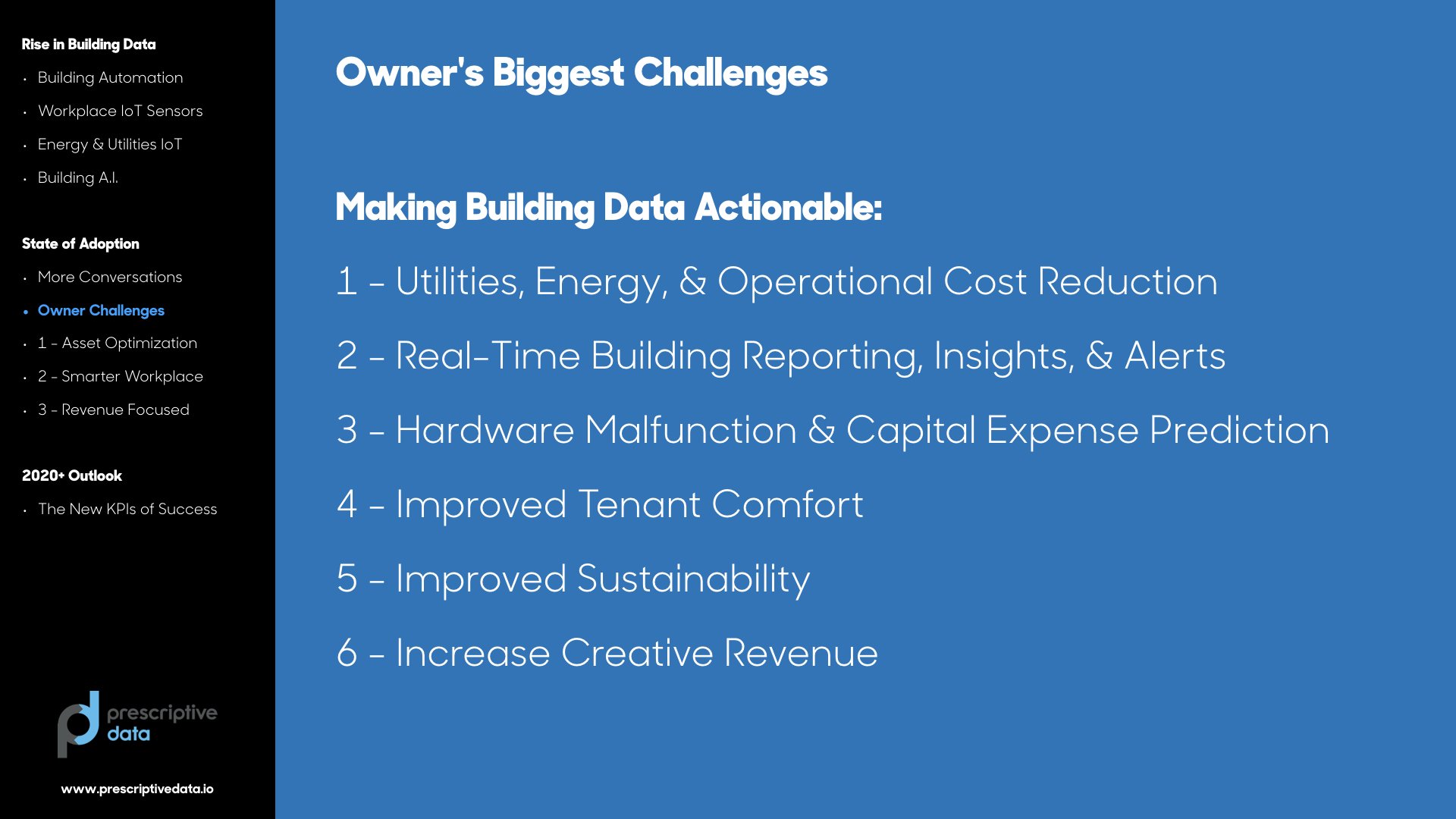

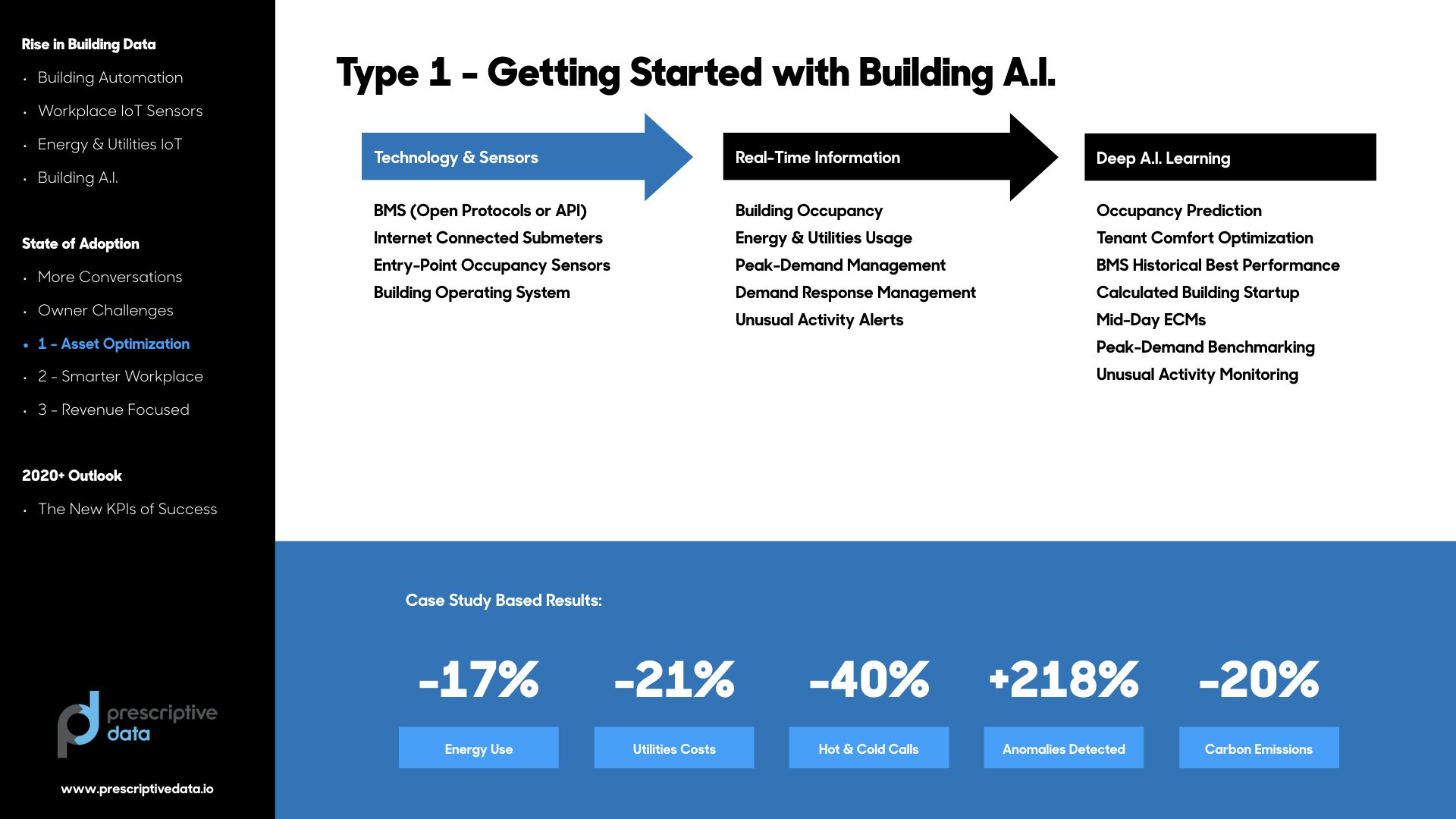

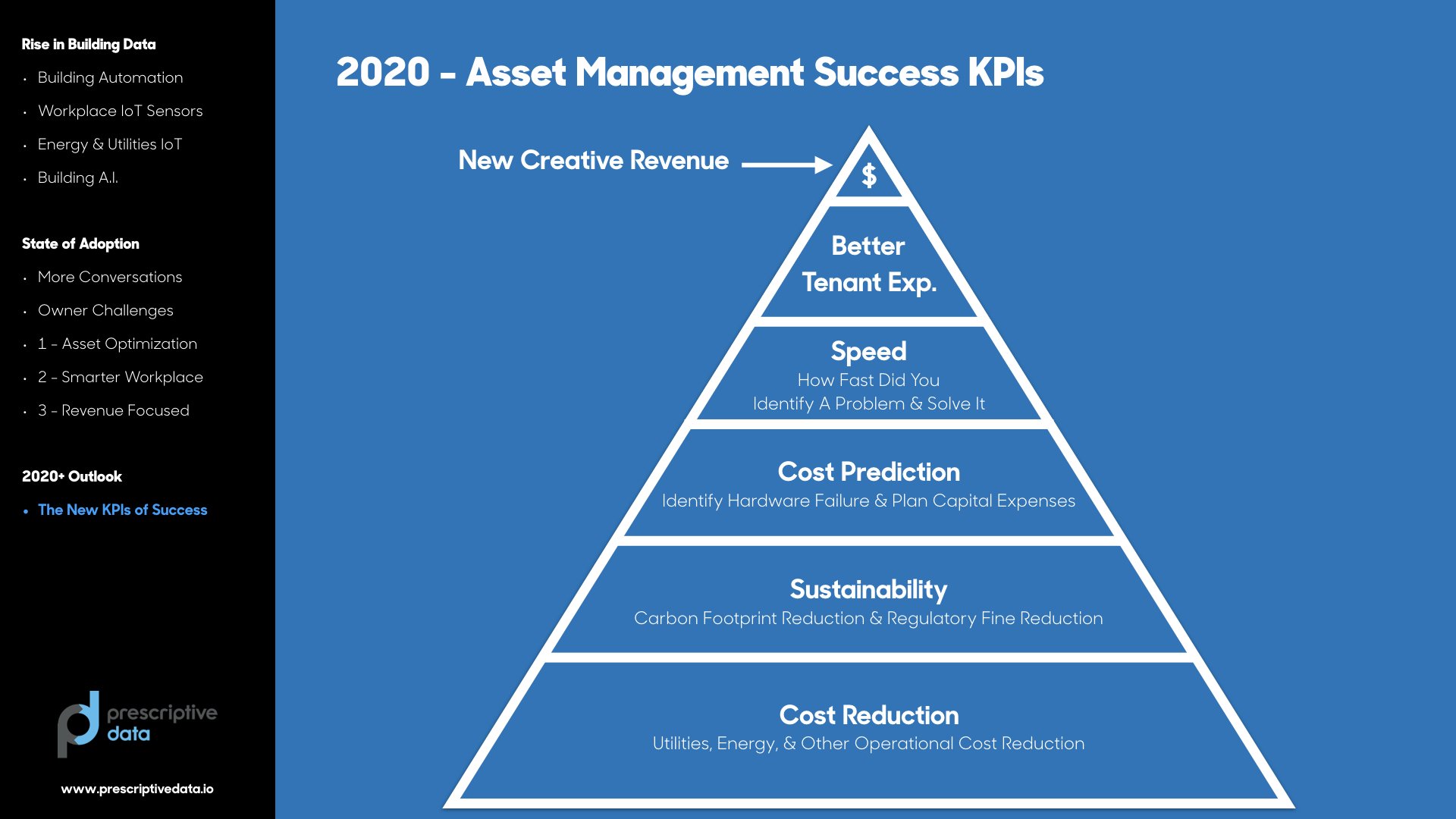

But sustainability is just one important metric for today’s real estate managers. The KPIs, or key performance indicators, in real estate asset management are changing. A central challenge for active asset managers has been the inability to get meaningful data by which to calculate KPIs. A new breed of smart tech is illuminating this data for investors like never before. “You can’t do anything clever within a building, whether it be for a building operator or for an asset manager until you can unlock that data,” Panda explained. Measuring retention, building performance, predictability, speed, and costs are KPIs that have been vastly improved by integrating smart tech into buildings and running the data through software like Nantum.

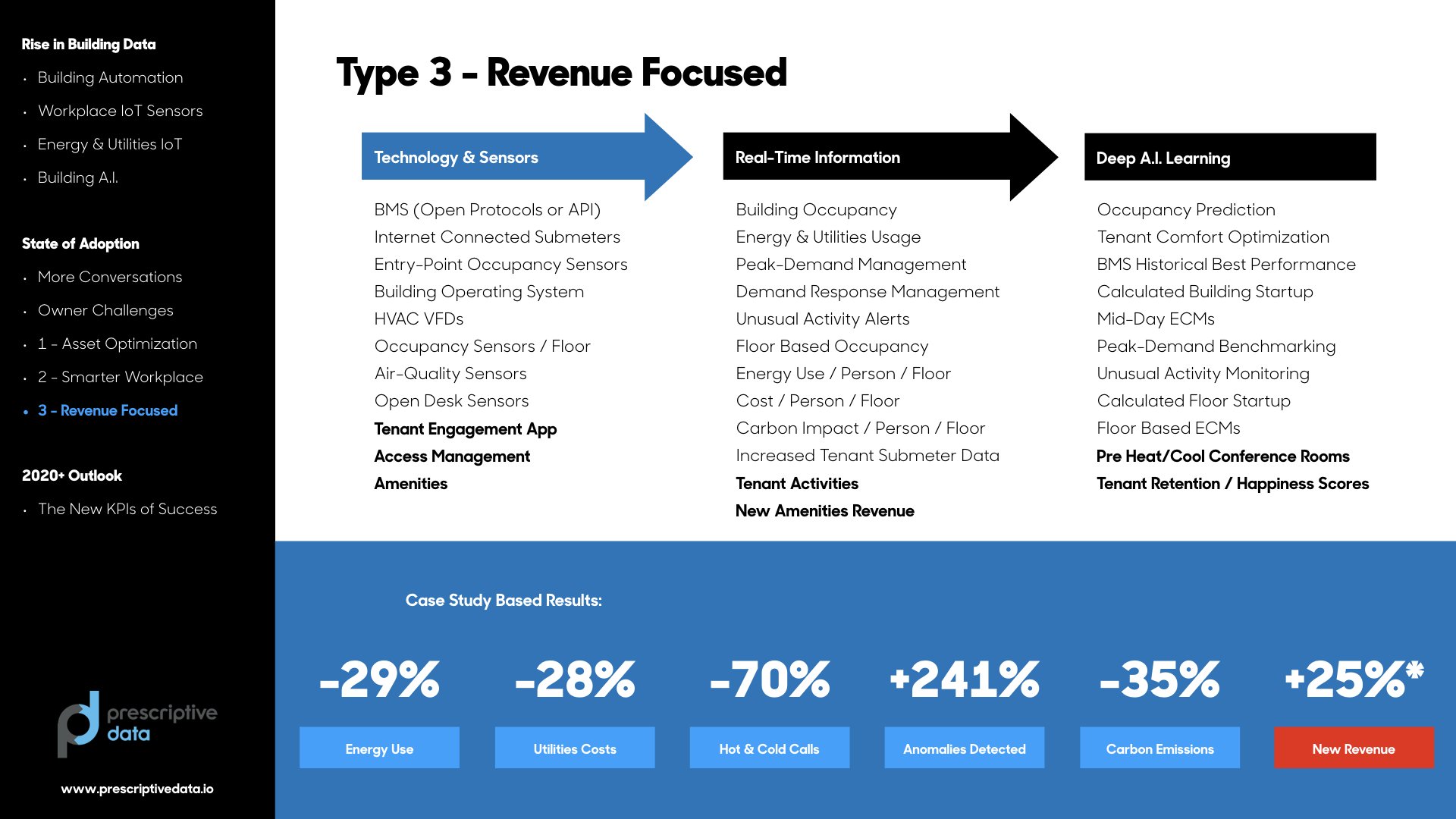

“Retention is at the top of this list, because that’s fundamentally where the revenue comes from, and that’s where the revenue persists.” Panda says. With smart tech, asset managers can be truly responsive to their tenants’ needs, be it hot and cold calls, or creating the right amenities package, and keep them as satisfied tenants for longer. “Our view is that data, especially surfacing data in the tenant space, is showing tenants how they can play a part in improving the overall ESG and sustainability footprints of the real estate that they occupy, [which] can dramatically change the dialogue between the landlord and operator and manager, and the tenants themselves.”

The second key KPI for Panda is building performance, which means “fundamentally being a more responsible owner and operator, or manager, or steward of the real estate for whatever period—whether it be a short term or long term hold—that you’re responsible for the real estate.” Panda stresses the ESG component of this KPI, adding that being a responsible building steward can mean “improving sustainability in the form of overall energy usage, mix of energy usage, integration with renewables. and just fundamentally being a more responsible member of the landscape.”

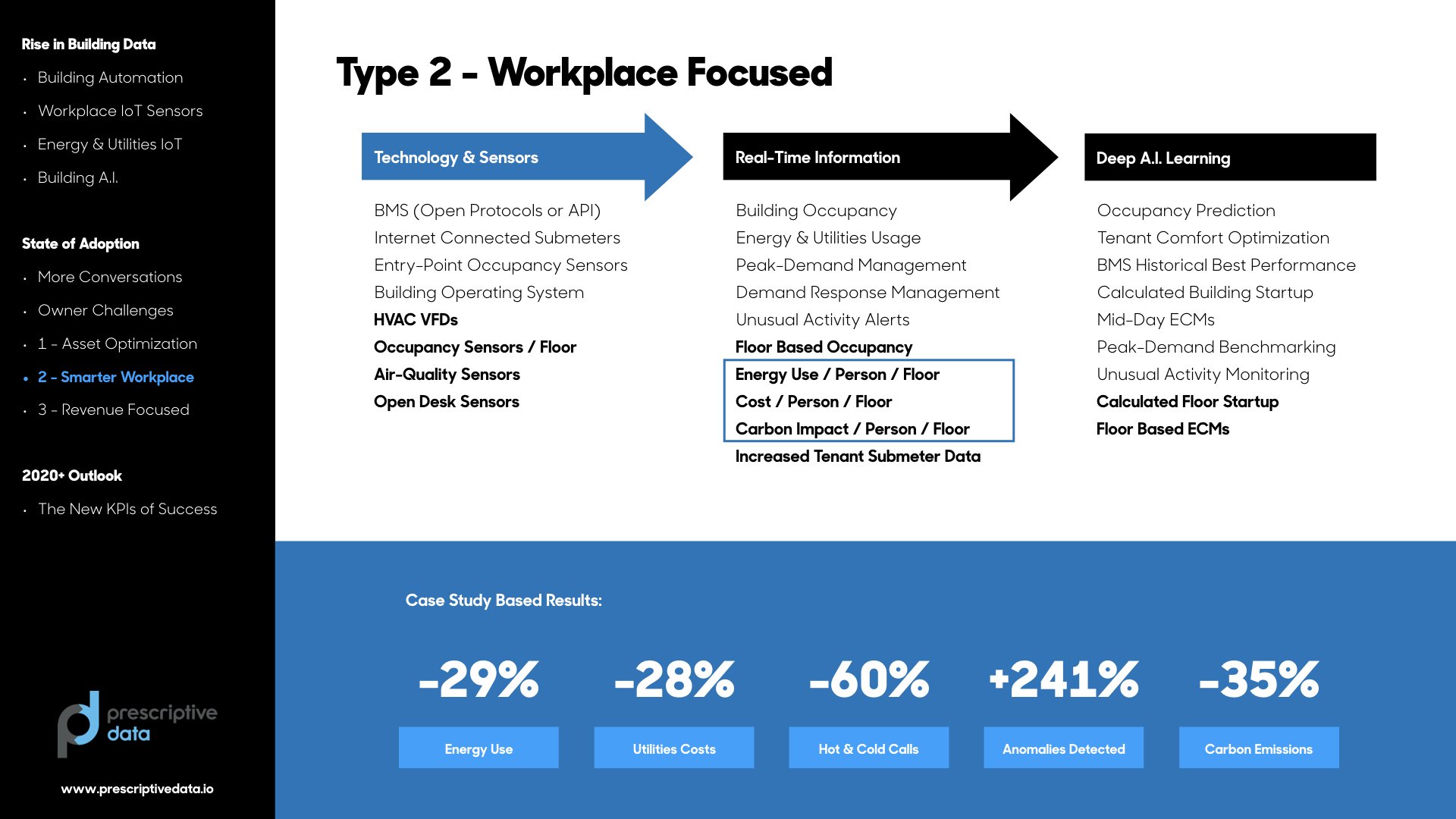

To illustrate this point, Panda refers to the investment firm BlackRock, which is the flagship client of their Nantum Workplace product. For BlackRock, Nantum Workplace is a way to demonstrate progress in their sustainability progress to employees, investors, potential recruits, and more. “In the Black Rock environment within their workplace, they are absolutely tracking which conference rooms are within acceptable bands from a CO2 levels standpoint,” Panda continues. BlackRock has also“focused on a new metric for ESGs and open desks, using energy use per person, energy cost per person, and carbon emissions per person as a metric for understanding and achieving their sustainability goals on an individual floor level.”

Predictability is the third key KPI, specifically in how net operating income drives long-term growth. “Net operating income is obviously interesting,” Panda says. “But it’s the persistence of net operating income—in its base form, or in its increased form—that ultimately drives asset appreciation. So, what this means is that [asset managers] are looking to be able to identify capital expense projects before they’re forced to have to do them so they can plan out the financing associated with them, [and] they can plan out the projects in a measured fashion.”

“It’s not really helpful to get data in arrears,” Panda adds, noting the importance of speed as a KPI. “You go out and you hire a consulting firm, they come back and they give you a study, that study usually languishes on the side of your desk in a binder for some period of time, maybe somebody looks at it, maybe somebody doesn’t. But, even if somebody chose to take action on it, you’re now taking action on data that is three months old, six months old.” The ability to gather troves of data and analyze it in real-time through software like Nantum, means that building owners and operators can not only pin-point issues quickly, but find new revenue opportunities at greater speeds too.

The finally key KPI unlocked by smart building tech is cost reduction. Panda recommends focusing on this metric “right out of the gate.” He says that “obvious targets are utilities, energy, and other operational costs, but presumably, as long as you don’t offset those reductions in costs with additional spend, it’s an immediate contribution to net operating income increasing.”

Ultimately, Panda believes asset managers that integrate smart tech and software like Nantum into their real estate will display it much like a LEED Platinum plaque. “You will take notice of the fact that the Nantum logo is on a building as a way to communicate that this is not only a truly intelligent building,” Panda concludes, “but one that excels across all the key KPIs that matter for that type of real estate.”

Speakers:

Sonu Panda

CEO @ Prescriptive Data

Propmodo

PROPMODO NYC 2019

More Event Videos